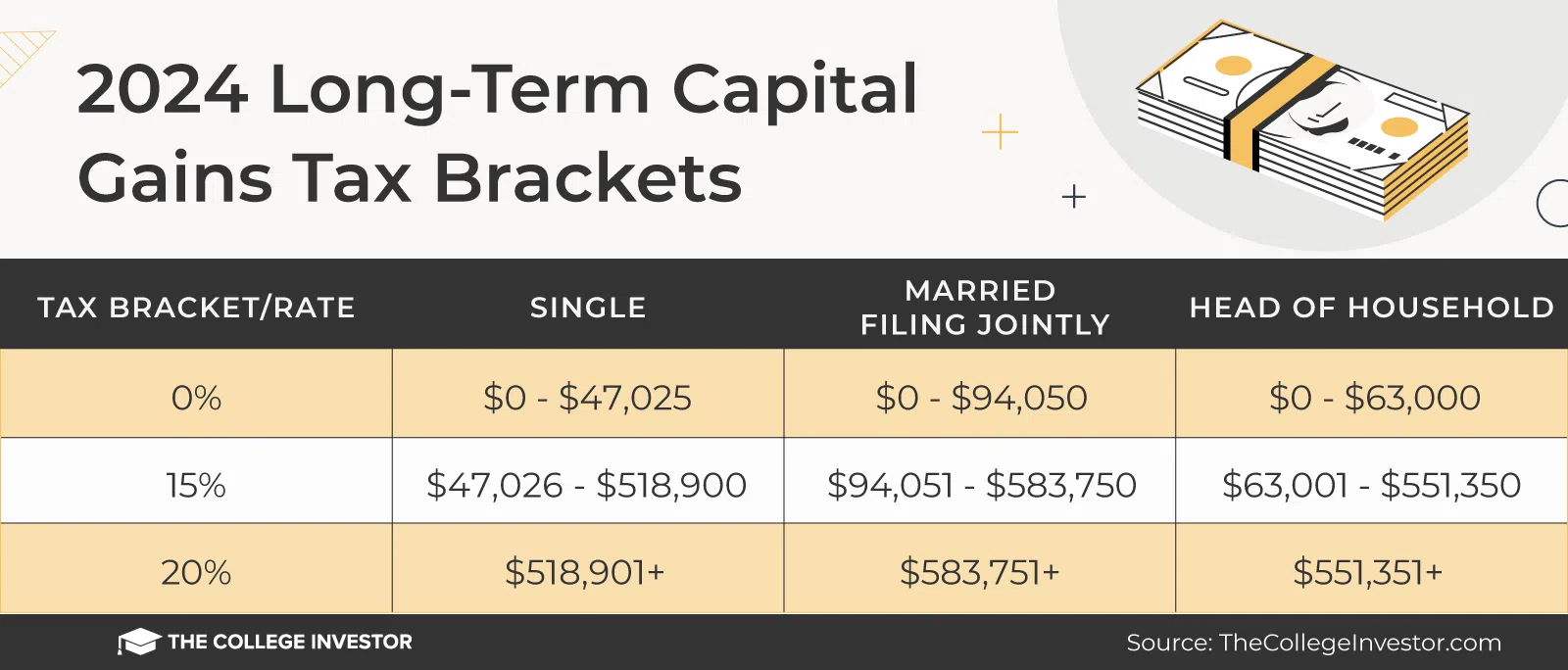

Tax On Long Term Capital Gains 2024. Based on filing status and taxable. 20% (for gains up to £50,000), 40%.

These are usually taxable at the individual’s applicable income tax slab rate. Individuals will be eligible for such exemptions if.

This Guide Provides A Detailed Overview Of, What.

What is long term capital gains tax or ltcg tax?

Individuals Will Be Eligible For Such Exemptions If.

The higher your income, the more you will have to pay in capital.

Ltcg Tax Is A Tax That Investors Need To Pay On The Profit Generated From The Sale Of A Capital Asset Held For.

Images References :

Source: fiannqshanie.pages.dev

Source: fiannqshanie.pages.dev

Capital Gains Tax Rate 2024 Dredi Ginelle, The higher your income, the more you will have to pay in capital. What is long term capital gains tax or ltcg tax?

Source: investplanadvise.com

Source: investplanadvise.com

Five Reasons to Use Roth IRAs Invest Plan Advise, 23 may, 2024 04:23 pm. The kind of asset and the relevant tax legislation determine the.

Source: investguiding.com

Source: investguiding.com

Capital Gains Tax Brackets For 2023 And 2024 (2023), We've got all the 2023 and 2024 capital gains tax. Depending on your regular income tax bracket,.

Source: www.finansdirekt24.se

Source: www.finansdirekt24.se

ShortTerm And LongTerm Capital Gains Tax Rates By, The higher your income, the more you will have to pay in capital. Single tax filers can benefit.

Source: kindnessfp.com

Source: kindnessfp.com

Capital Gains vs. Ordinary The Differences + 3 Tax Planning, You have the ltcg tax on rs. Capital gain is an income tax levied on the sale of assets such as real estate properties (house), financial investments made through banks like fixed deposits (fds).

Source: www.financialsamurai.com

Source: www.financialsamurai.com

ShortTerm And LongTerm Capital Gains Tax Rates By, Single tax filers can benefit. Against this backdrop, reports have emerged that labour may soon bring capital gains tax (cgt), levied at a variety of rates ranging from 10pc to 28pc depending.

Source: www.youtube.com

Source: www.youtube.com

What is long term capital gains tax? EXPLAINED All you need to know, Capital gain is an income tax levied on the sale of assets such as real estate properties (house), financial investments made through banks like fixed deposits (fds). 23 may, 2024 04:23 pm.

Source: www.businessinsider.in

Source: www.businessinsider.in

Capital gains tax rates How to calculate them and tips on how to, This guide provides a detailed overview of, what. Capital gain is an income tax levied on the sale of assets such as real estate properties (house), financial investments made through banks like fixed deposits (fds).

Source: www.transformproperty.co.in

Source: www.transformproperty.co.in

Capitalgainstaxinfographic Transform Property Consulting, High income earners may be subject to an additional 3.8% tax called the net investment income tax on both. Single tax filers can benefit.

Source: www.youtube.com

Source: www.youtube.com

Differences between Short Term and Long Term Capital Gain. YouTube, Thus, the taxpayer reported income under the head 'capital gains' after. The ltcg (long term capital gains) tax rate on equity funds is 10% on ltcg exceeding.

This Guide Provides A Detailed Overview Of, What.

You have the ltcg tax on rs.

When You Sell Certain Assets You've Held Onto For Over A Year Or Two, Like Stocks, Mutual Funds, Or Property, You Might Have To Pay A Tax.

Ltcg tax is a tax that investors need to pay on the profit generated from the sale of a capital asset held for.