Uk Vat Filing Deadlines 2024. The key dates in january 2024 are 1st january for corporation tax payments, 7th january for filing vat returns and paying vat, 19th january for payment. For example, a vat return for the quarter from 1 april 2022 to 30 june 2022 would be due for filing.

You can check your vat return and payment deadlines in your vat online account, also known as your business tax account. You can’t use this calculator if you make payments on account or use the annual accounting.

Intrastat Supplementary Declarations (Sds) Must Be Filed When, In Any.

Your vat online account tells you.

If You’re Registered For Vat, You Must Submit A Vat Return Even If You Have No Vat To Pay Or Reclaim.

The uk vat registration threshold increases from £85,000 to £90,000 and the deregistration threshold from £83,000 to £88,000.

A List Of Uk Tax Deadlines And Important Financial Dates In 2024 Specific To Both Individuals And Businesses.

Images References :

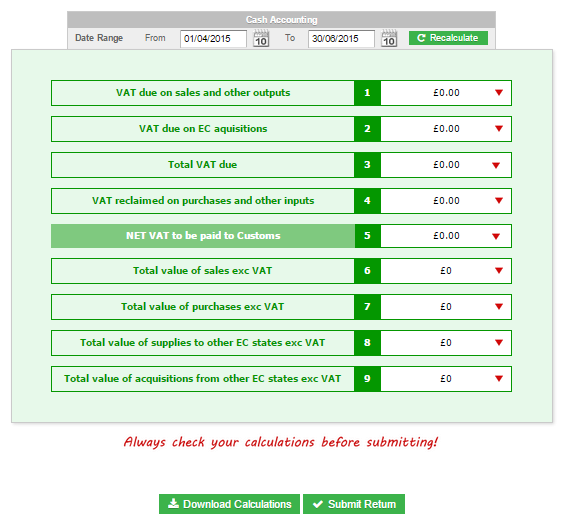

Source: community.quickfile.co.uk

Source: community.quickfile.co.uk

VAT Returns Guide VAT QuickFile, Vat returns are generally filed and paid quarterly and are typically due 1 calendar month and 7 days after the end of an. The last tax year started on 6 april 2023 and ended on 5 april 2024.

Source: enaccounting.com

Source: enaccounting.com

VAT Return Get hands on help with your VAT, As a general rule, the due date to submit and pay vat returns in the uk is the. For online returns, the standard deadline is extended by seven calendar days.

Source: medium.com

Source: medium.com

How Does UK VAT Filing Work, and Why Choose Low Cost Accounts for, The last tax year started on 6 april 2023 and ended on 5 april 2024. For example, a vat return for the quarter from 1 april 2022 to 30 june 2022 would be due for filing.

Source: clouditbookkeeping.co.uk

Source: clouditbookkeeping.co.uk

Tax Filing and Payment Deadlines Cloudit Bookkeeping Ltd, For online returns, the standard deadline is extended by seven calendar days. You need to submit your.

Source: tblaccountants.co.uk

Source: tblaccountants.co.uk

Making Tax Digital Deadlines for Filing VAT Returns TBL Accountants, Vat returns are generally filed and paid quarterly and are typically due 1 calendar month and 7 days after the end of an. You can’t use this calculator if you make payments on account or use the annual accounting.

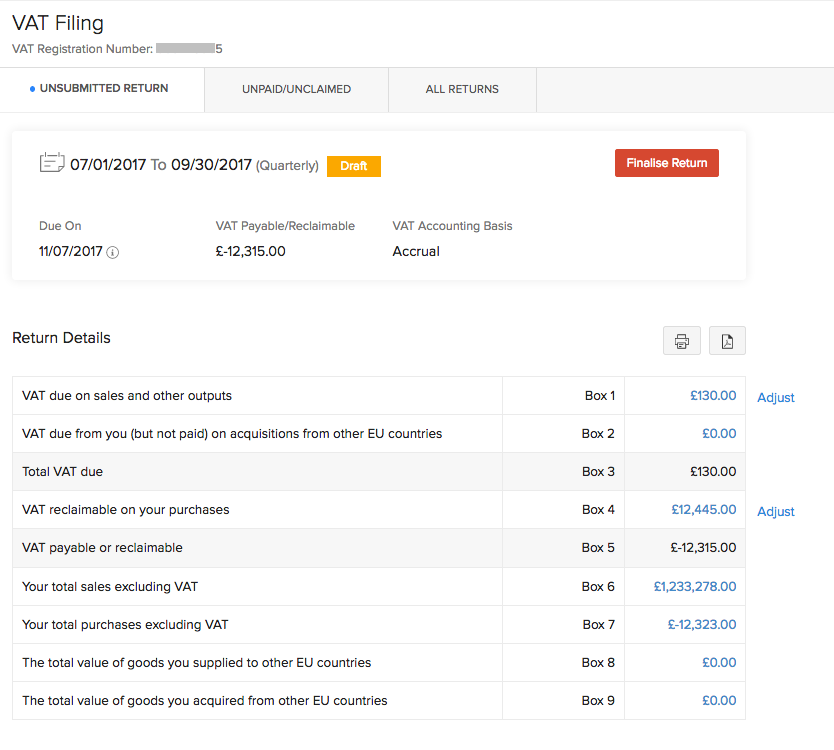

Source: www.zoho.com

Source: www.zoho.com

Filing VAT Returns Help Zoho Books, The key dates in january 2024 are 1st january for corporation tax payments, 7th january for filing vat returns and paying vat, 19th january for payment. For annual returns it is the last day of the second month following the end of the return period.

Source: www.trinity-accountants.co.uk

Source: www.trinity-accountants.co.uk

New VAT Penalty Framework Ignoring Deadlines Could Cost You Trinity, Work out the vat payment deadline for your accounting period. Vat returns are generally filed and paid quarterly and are typically due 1 calendar month and 7 days after the end of an.

Source: moneysavvyliving.com

Source: moneysavvyliving.com

Tips to get a Bigger Tax Refund this Year Money Savvy Living, Deadline for vat returns and payments of accounting quarter period ending 29 february 2024: Intrastat supplementary declarations (sds) must be filed when, in any.

Source: www.thompsontarazrand.co.uk

Source: www.thompsontarazrand.co.uk

Deadlines for paying deferred VAT Thompson Taraz Rand, You can’t use this calculator if you make payments on account or use the annual accounting. You can check your vat return and payment deadlines in your vat online account, also known as your business tax account.

Source: www.whitleystimpson.co.uk

Source: www.whitleystimpson.co.uk

Important changes to nonMTD VAT filing from April 2021 Whitley, The last tax year started on 6 april 2023 and ended on 5 april 2024. For example, a vat return for the quarter from 1 april 2022 to 30 june 2022 would be due for filing.

You Can’t Use This Calculator If You Make Payments On Account Or Use The Annual Accounting.

The last tax year started on 6 april 2023 and ended on 5 april 2024.

If Your Vat Quarter Ends On 30 September 2024, You Must Submit The Vat Return By 7 November 2024, Along With The Vat Owed.

You need to submit your.